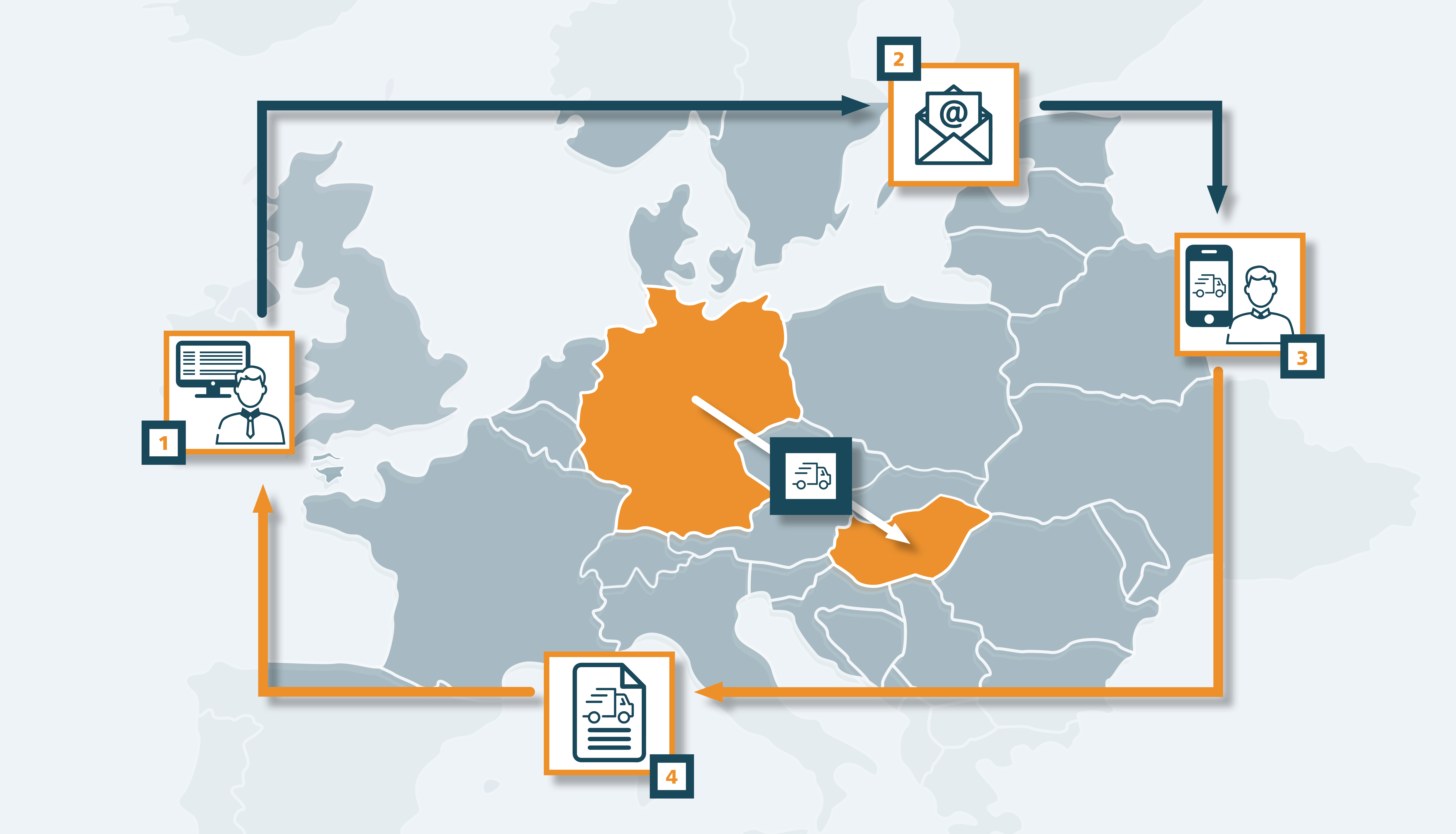

THE DIGITAL CONFIRMATION OF ARRIVAL.

Cost reduction, speed and security for exporters.

Germany has finally also reached the digital age where confirmations of arrival are concerned.

As a specialist in digital solutions, Intareg has developed a patented Confirmation of Arrival based on over 25 years of experience.

The Digital Confirmation of Arrival fulfils the requirements of Section 6a (4) of the Value Added Tax Act (UStG) in every aspect and thus replaces the paper-based proof of arrival used previously.

Take advantage of the Digital Confirmation of Arrival for your export transactions.

Save considerable time and costs and be on the safe side at all times.

The Intareg document contains:

- VAT identification number

- Automated retrieval of the VAT identification number of your business partner in another EU country by the Federal Central Tax Office in Saarlouis.

- Proof of border crossing

- Linking the GPS data of the recipient in real time with photos of the asset at the place of arrival.

- Recipient data

- All the data of the recipient with VAT identification number and asset data.

- Digital signature

- With date and GPS data for the location.

- Haulier/carrier data

Recording of all data in the Intareg web portal

- The exporter enters all the required data regarding their company, the customer and the asset being exported into the Intareg web portal before shipping it.

- Details of the asset include the serial number, manufacturer, model, year of construction, net weight in kg, value of the goods and the currency.

- Details of the exporter and recipient as the agent include the company, name, address, contact details, VAT ID and anticipated date of arrival for the recipient.

- Depending on the delivery date and the transport time, the exporter or their service provider determines the execution date of the Digital Confirmation of Arrival.

E-mail with link to the Intareg web portal

- The recipient of the asset being exported receives an e-mail from the Intareg system with a link to the Intareg web portal.

- The e-mail can also be forwarded to other recipients to create the Confirmation of Arrival in the event that another contact person is responsible.

Simple documentation instructions

- The recipient opens the link on their smartphone or tablet.

- They receive simple technical instructions for documenting the asset in photographs.

Automatic generation of the Digital Confirmation of Arrival

- If carried out successfully, the Digital Confirmation of Arrival is automatically generated.

- The exporter receives the Digital Confirmation of Arrival as a PDF file within a very short period of time.

- Photos, GPS data and detailed asset data are documented.

- The arrival of the asset is demonstrated in a legally-compliant, fraud-proof and efficient way for both contracting parties.

- Any personal data is then deleted from the system.